How To Make Money In Property and what You Need

how to make money in property and what you need

You can make money in property through various strategies, primarily via

appreciation (increase in property value) and rental income.

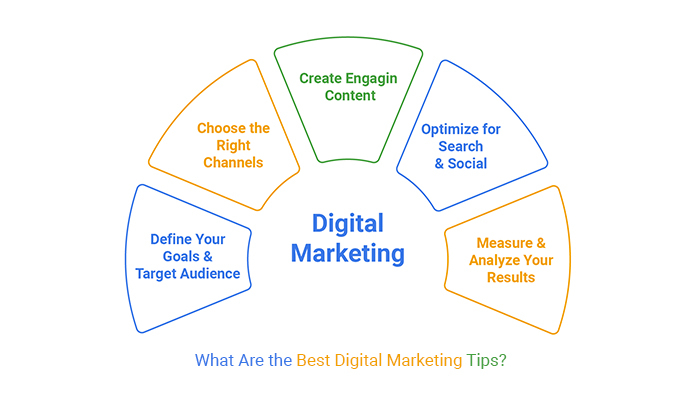

Key strategies

- Buy and Hold: Purchase a property and rent it out to tenants for regular income, benefiting from long-term appreciation.

- Flipping: Buy undervalued properties, renovate them, and resell quickly for a profit.

- Real Estate Investment Trusts (REITs): Invest in companies that own income-generating real estate, receiving dividends without direct property management.

- Real Estate Crowdfunding: Pool money with other investors for larger real estate projects.

- House Hacking: Live in a part of the property and rent out the rest to help cover expenses.

- Wholesaling: Contract to buy a distressed property at a discount, then sell the contract to another investor.

What you need

- Clear Goals: Define whether you seek rental income, capital growth (equity) a quick turnerover aka flipping , or a mix of all 3.

- Financial Readiness: Assess your savings, income, and emergency fund (ideally 6 months of expenses).

- Market Knowledge: Research local market trends, property types (residential, commercial, etc.), and financing options.

- Financing: Explore options like conventional loans, buy-to-let mortgages, hard money loans, or private lenders. Lenders typically require a 20-40% deposit for investment properties.

- Professional Team: Consider working with real estate agents, conveyancers, contractors, and financial advisors.

- Property Management: Decide whether to self-manage or hire a property manager for tasks like tenant screening, maintenance, and rent collection.

Key factors for success

- Location: Invest in areas with strong rental demand, good amenities (schools, transport), and growth potential.

- Property Condition: A well-maintained property is more attractive and commands higher rent/resale value.

- Market Timing: Understand real estate cycles and market conditions (e.g., buyer’s vs. seller’s market).

- Risk Management: Diversify investments, maintain a financial cushion for unexpected costs, and stay updated on legal and tax regulations.

How to make money in property and what you need ie good credit and understanding what makes a property worth buying types of mortgages How To calculate a rental yield and the permits needed for HMO Properties

To make money in property, you need a good credit history, an understanding of what makes a property a good investment, knowledge of the right types of mortgages, a solid grasp of how to calculate rental yield, and the appropriate licenses for properties like Houses in Multiple Occupation (HMOs)

.

What you need for a mortgage

Good credit

While no universal minimum credit score exists, the higher your score, the better your chances of securing a mortgage with a competitive interest rate. To improve your credit rating, you should:

- Pay bills on time: This includes credit cards, utility bills, and other loans.

- Register on the electoral roll: Registering your address helps prove your identity.

- Avoid maxing out credit cards: Keeping your credit utilization low is seen as a positive.

- Check your credit report: Review your report for errors and have them corrected.

Types of mortgages

When purchasing an investment property, you will need a specialized mortgage.

- Buy-to-Let mortgage: This is for properties you intend to rent out. The amount you can borrow is based primarily on the expected rental income, which typically needs to cover at least 125% of the mortgage payments.

- Interest-only mortgage: Most Buy-to-Let mortgages are interest-only. This means your monthly payments cover only the interest, not the capital. You will need a plan to repay the original loan amount at the end of the term, for example, by selling the property.

- Larger deposit: Lenders typically require a higher deposit for a Buy-to-Let mortgage, often between 25% and 40%.

How to find a profitable investment property

A lucrative investment property offers a strong combination of rental income and potential for capital growth. Key factors to consider include:

- Location: Look for areas with strong rental demand, good transport links, local amenities, and economic growth. University cities and regeneration areas often perform well.

- Rental yield: A property’s rental yield helps assess its profitability. A higher yield is generally better, but must be balanced against stability.

- Condition: An undervalued property in need of refurbishment can offer a high return, but requires significant capital and management. Move-in-ready properties offer more immediate rental income.

- Target tenants: Identify your target market, whether it’s students, young professionals, or families, as this influences the ideal location and property type.

How to calculate rental yield

There are two main types of rental yield calculations.

Gross rental yield

This gives a quick, broad view of a property’s profitability by comparing its annual rental income to its purchase price or market value. It does not account for any expenses.

Calculation:

- Step 1: Calculate your annual rental income (monthly rent x 12).

- Step 2: Divide the annual rental income by the property’s purchase price or current market value.

- Step 3: Multiply the result by 100 to get the percentage.

Net rental yield

This provides a more accurate picture of profitability by factoring in your annual running costs, such as maintenance, insurance, and mortgage interest.

Calculation:

- Step 1: Calculate your annual rental income (monthly rent x 12).

- Step 2: Calculate your total annual running costs (mortgage interest, insurance, maintenance, agent fees, etc.).

- Step 3: Subtract the annual costs from the annual rental income to get your net annual income.

- Step 4: Divide the net annual income by the property’s purchase price or current value.

- Step 5: Multiply the result by 100 to get the percentage.

Permits for HMO properties

A House in Multiple Occupation (HMO) is a property rented out to at least three tenants who form more than one household and share facilities like a kitchen or bathroom.

HMO licences

- Mandatory Licence: A mandatory HMO licence is required nationwide if your property is rented to five or more people from two or more households.

- Additional Licence: Your local council may require an additional licence for smaller HMOs (e.g., three or four people) or certain converted buildings.

- Checking requirements: You must check the specific licensing requirements with your local council, as rules and fees can vary significantly.

Conditions and safety checks

To obtain an HMO licence, you must ensure the property meets various safety and space standards. You will need to provide documentation for:

- Gas Safety Certificate: Must be renewed annually by a Gas Safe registered engineer.

- Electrical Installation Condition Report (EICR): Required every five years by a qualified electrician.

- Fire safety: Evidence of working smoke alarms and, where applicable, emergency lighting.

- Minimum room sizes: The property must meet minimum room size requirements for the number of occupants.

- Fit and proper person: The council will check if the landlord is a “fit and proper person” to hold a licence, looking at any unspent convictions for housing-related offences.

AI

Post Comment